My dad is a car guy. My brother is a car guy. My husband is a car guy's car guy.

Dear readers, I am not a car guy. I judge vehicles by their colors. Green ones are the best. Thus, my car guy husband will inform you. He's pretty good at explaining this stuff, so let's give it a go.

Sage & Mint: Hey, husband. How do I buy a car?

Car Guy Husband: Well, first: If you own a car and it's paid off or almost paid off, it's the cheapest option 99% of the time.

Sage & Mint: Ok, but let's say I am in the market to purchase a car. Where do I start?

Car Guy Husband: You should conduct a needs analysis.

Sage & Mint: Boy car guy husband, you must be a businessman. Can you translate that last part into normal language?

Car Guy Husband: It just means you need to figure out what's important to you and what you need in a car purchase.

-Do you live in a snowy/hilly place? 4-wheel drive suddenly becomes more important.

-Is your commute awful? Great gas mileage would be nice.

-Does your body temperature run perpetually cold? Maybe you should be introduced to heated seats…

Sage & Mint: Ok, so once we figure out what we need and want, what's next?

Car Guy Husband: Next you decide your budget. The easy rule is you can usually afford to buy a car up to 20% of your salary (or your joint salary if you’re married).

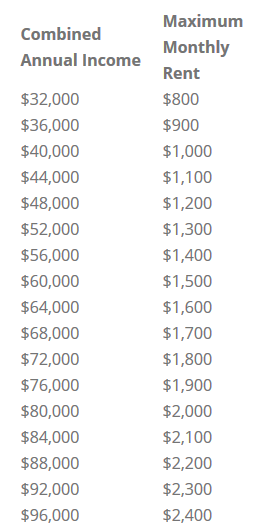

Cheat sheet on how much car you can afford in a perfect utopia:

$30,000 salary = $6,000 car

$45,000 salary = $9,000 car

$60,000 salary = $12,000 car

$75,000 salary = $15,000 car

$90,000 salary = $18,000 car

Sage & Mint: I'm going to interrupt real quick. If you’re totally new to car world and don’t have a grasp of car costs, a very very basic new Ford Focus will cost about $17,000. That’s roughly $200 a month in a 6-year finance plan.

With used cars, prices are a little different. Here’s my Yelp-like pricing rundown on used cars:

$

$3,000-$8,000 cars. On Yelp, these are the McDonald's, Subways, and hole-in-the-wall-delicious-Mexican restaurants. In the car world, these are probably going to need a little work, or might have rust or a dent. They'll get you from point A to point B, but expect to have some repairs done at a local shop following your purchase.

$$

$9,000-$15,000. Via Yelp, these are your gastropubs and breweries. You will get from point A to point B, your car will have a smaller chance of needing expensive repair or maintenance and you might even get a sunroof. These cars are probably less than 10 years old and still have mileage under 100,000 (luxury cars not included). A big chunk of your coworkers probably drive these cars.

$$$

$15,000+. These are you romantic dinner spots on Yelp. You will get from point A to point B in style, with warm buns, and maybe even backup beeps (awesome). Expect these cars to have relatively low miles and newish, unless (again) your eye is turned toward luxury brands.

Ok, back to you Car Guy Husband:

Car Guy Husband: Right, so used cars can be a great idea for 20-somethings who don’t have tons of money yet.

Once you figure out how much you can afford, let’s figure out how to pay for it. In the ideal world, you’ll have an extra $5,000-$10,000 in the bank to pay cash, but that is unrealistic for some. If your bank account isn’t so flush, let’s look at your payment options: you can get a loan from your parents, a loan from the bank or credit union, car dealer financing, or a loan from the car manufacturer.

Parent loan: The upside is the flexibility and lower (if any) interest. The downside is borrowing from family is a sticky situation in general. Make sure all parties are in agreement on loan repayment and maybe even write out a contract.

Bank/Credit Union loan: The upside is loan rates are currently fairly low (less than 5% usually), the downside is you’re still paying a lot in interest. If you choose this route, go into your bank to get a loan pre-approved for an easier buying experience.

Car manufacturer loan: The upside is shiny deals like 0% down or a very low interest rate. The downside is they're usually only for new or certified pre-owned cars and wording can be tricky. Read the whole payment plan and make sure your interest won’t balloon after a certain number of years.

Car dealer financing: The upside is the convenience. You buy your car and sit down with a finance guy right at the dealership. The downside is they are professional upsellers, and you might end up paying more than you intended. It’s especially important to plan your payment schedule (a 60-month lease=5 years) and stick to it. Car dealers tend to push out your loan to make monthly payments more manageable.

There you have it! Your first steps in buying a car. Up next: what cars you should buy and how to rock a dealership visit.