Don't spend more than you earn.

This is the number one rule for personal finance. It's oozing so much with wisdom it'll explode like Gushers in your mouth.

So why are we even going over this? Isn't it obvious that we shouldn't spend more than we earn? Well, yes...but that's where credit cards come in.

Credit card companies will loan you money for everyday expenses, just like a good 'ol pal, knowing you'll pay your debts like a true Lannister (Game of Thrones, anyone? Anyone?). Ok well - don't use that pretty little shiny bit unless you actually have the money in your account to cover it. No trips to Mexico unless you got the cash up front. Same for buying a new puppy, moving to a new place, buying a car, and your weekly coffee habit. Just say no. To drugs. And to spending money you don't have.

Let's divvy up your expenses. Here's an oft-quoted and nicely divided rule if you need a jumping point for your budget. It's called the 50/20/30 rule (I agree, it's not the most memorable of rules). But let's be honest, you don't need to remember it frequently, just when you initially start budgeting.

50% You should spend no more than half of your take-home pay (that's after taxes) on essentials (food, housing, utilities, and transportation). 20% Save, save, save! This healthy chunk of pie goes to responsible decisions. Pay off your debt, save for retirement, and stash away like a squirrel preparing for winter. 30% Fun budget/life budget. Use 30% of your pay for things like clothes, eating out, phone bill, internet, charity, child care, gym dues, pets, etc. etc. etc.

These percentages aren't hard rules, just guidelines. I'm more in favor of upping the ante on saving if you can. My ideal percentages are heavier on saving a little lighter on essentials (just pay less for your house/apartment/car!).

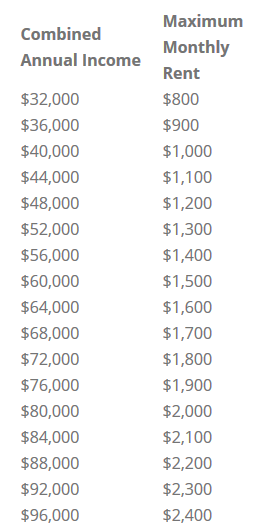

One of the biggest perpetrators can be a rent payment (or a mortgage). Rent can be expensive, especially if you're a gal living in the city. Try really hard not to spend more than 30% of your income in rent -- especially because this money is pretty much just vanishing at the end of the month (unlike paying a house mortgage, where you get to sell the actual house at the end). Here's a great chart (hat tip nakedapartments.com) to figure out how much you can afford in rent. *For total income, if you're married or sharing expenses with a partner, include their salary too.