College is great -- but gosh, education is expensive these days! The class of 2013 held an average debt load of over $30,000 per student. Yikes!

So let's talk student loans: Ideally we'd love to pay off our loans sooner rather than later, because that means you end up saving more in the long run (and golly, isn't it a long run?). But life is expensive! I know, I know!

Although this tip is way down at #9, think of it far higher in terms of priority. The sooner you pay off your debt, the more money you can save for a house, a baby, a dog, and retirement. All those grown-up life steps.

So let's look at smart moves to paying off student loans: 1. First and foremost, set up auto-deduction. Easy-peasy. You pay loans on time and it won't be quiiiite as painful as writing a check every month.

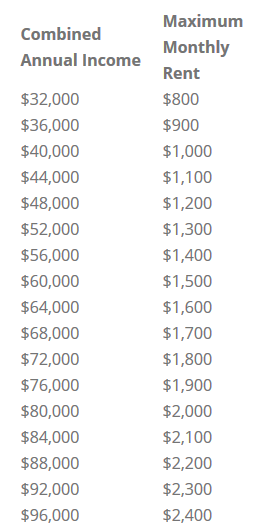

2. With federal loans, choose your repayment schedule wisely. There are five repayment options ranging from a 10-year, $50/month minimum plan to an income-based plan. Use this handy student aid guide to figure out what plan best fits your budget.

3. Prioritize based on interest rates. Pay off higher-interest rate loans first. If you have an extra chunk of change this month, chip it in to the loan that's feeding off of a double-digit interest rate. One interesting thing to note: the exception to this rule is private variable-rate loans. This means your interest rate can change. Translation: it can go up! And currently, this interest rate is relatively low, which probably means it will shoot up in the coming years, so pay off that bad boy ASAP.

4. When student loan payments end, CELEBRATE. You have moved a mountain, my friend, so please do your happy dance accordingly. Maybe you can take the money you would've spent on next month's loan repayment and take a little mini vacation. Or buy a fabulous pair of shoes. Or all the chocolate milk you could possibly drink. Go crazy, because paying off loans is a BIG DEAL.

Side note: I didn't touch on credit card debt, but you can take gems #1-#4 and apply it to your plastic as well. But girl, if you have to give up living a fabulous lifestyle to pay off your credit card debt, don't do it. Just kidding. Do it, definitely do it. And fast. Forget the faux-leopard coat and lululemon-everything workout apparel. Heres another great calculator to help you plan.

The sooner you pay off your debt, the less you end up owing! More money in the bank for you!