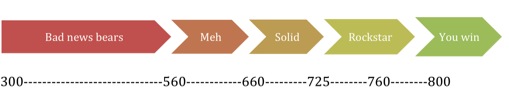

Think of your credit score as a game—slightly silly and somewhat illogical. You see, credit is not a measure of your Richie Richness, it’s a measure of your financial reliability (snore). Banks and lenders use this number (somewhere between 300 and 850 on the standard scale) to determine how much money they should lend you (if any at all). The higher your credit score, the better.

A quick breakdown:

Right then, so how do you move from bad news bears to rockstar status?

Listen close, grasshopper:

1. Make your payments on time.

C’mon, this one is easy: AUTO-PAYMENTS. Technology does the remembering for you.

2. Show some commitment.

It might not be your favorite word, but credit card companies like to see a history of on-time payments. This also leaves room for a catch-22 of credit—if you don’t have credit, it’s hard to get! A tip for those in this boat, get a store credit card like Macy’s or Walmart to start out—these have laxer approval requirements. Another workaround is to get a bank credit card. If you have a good chunk of change in your bank, some will give credit based on income and current savings.

3. Don’t collect cards.

This isn’t Pokémon, friends, you don’t have to catch ‘em all. Two to three cards are probably enough.

4. Spend 30 percent or less than your limit.

This might just be magic juju hullabaloo, but I’ve heard this wisdom passed around a few times. Something about debt-to-credit ratio? We’re just playing the game.

5. Charge only what you can afford.

It’s not an extension of your income. Try REALLY hard not to use it as a crutch when you don’t have enough in your bank account. Interest sucks.

6. Lines of credit are good.

These come in the form of student loan debt, mortgages, and car payments. By making consistent payments on these additional lines of credit, you’re showing history and trustworthiness.

Now you know how to play the game, go forth and achieve rockstar status, and maybe you can even win the whole game.

Don’t know your credit score? You’re entitled to one free check a year.