This was the first year we’ve ever done taxes, because we had a tax guy and then we moved away. Is this your first time too? Buckle up, buttercup: here's what to expect.

The rundown

What: taxes

When they're due: anytime between now and April 18, 2017

Time required: Depends...

- Do you have the focus of a laser pointer and the tenacity of a honey badger? Schedule 2-3 hours. Take a break in the middle if you need to.

- Are you more of a wanderer? Earmark the better part of a Saturday: this might not be your favorite day of the year.

What it costs for tax prep:

- Free for simple taxes: If you make less than $100K per year and have simple taxes (you're a renter, one job, you're not going to itemize deductions), you can take advantage of some of the free online options out there. If you're an easy-peasy tax filer, I recommend you get started with TurboTax, who wins the award for prettiest UI. Put your game face on though, watch out for upcharges and read all the fine print.

- $40-$100 for slightly more complicated tax filings*: If you own a house, rent out properties, have a side hustle, or have a more complicated tax situation than the average recent grad, look into a paid version of tax prep: there are lots of helpful guides and resources at your fingertips. The online tax prep companies charge roughly the cost of a dinner for two. You can even pay for it through your return for an added fee (it's slightly reminiscent of some of the nickel-and-dime airline carriers like Spirit or Frontier, so read all the fine print).

- TaxAct is going to be the cheapest (in the $40 range), but it's fairly basic in its offerings.

- H&R block is the next level up in the $50-70 range. Lots of people recommend it; it's a solid option.

- TurboTax is viewed as the Apple of the tax world with a great user design, but a higher price tag in the $70-$90 range.

- $150-$500 for a tax professional to file for you: If you want absolutely nothing to do with your taxes, you can drop off all your paperwork with an accountant and wipe your hands of the whole thing. This becomes increasingly enticing for complicated tax situations, high-income earners, and business owners.

*Note on payment: be a good millennial and take advantage of cookies. Sometimes if you visit the site and come back later, they'll offer you a discounted rate.

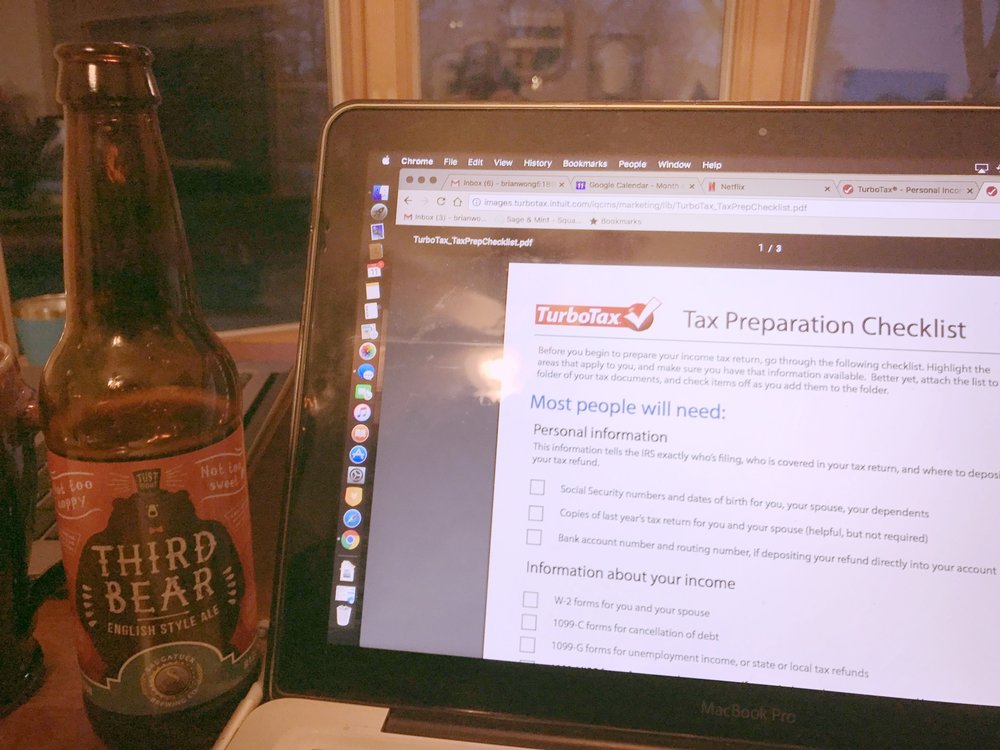

What you need: a bunch of paperwork and all your account passwords handy. Use this checklist to guide you. Yes, it's from TurboTax. They're not even paying me for this post: their content is just so on point.

Doin' It: Filing Taxes

We debated between TurboTax and H&R block, but after calling my financially super savvy brother-in-law, he said, “I freaking love TurboTax.” He’s never had a bad experience. So that was that: TurboTax for the win.

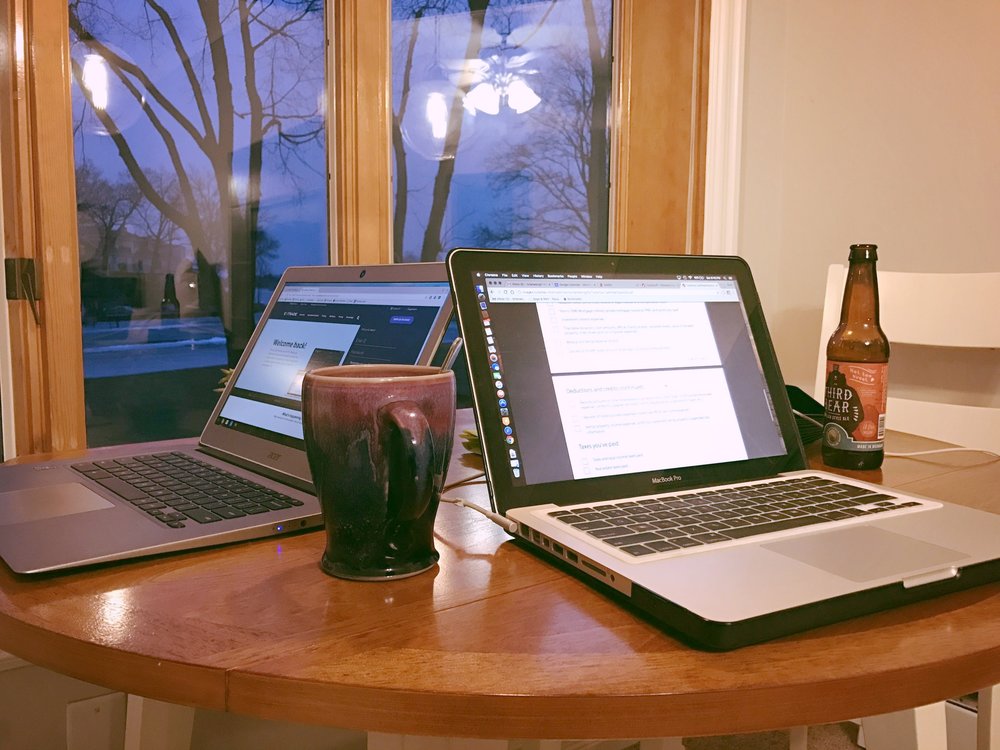

We collected our paperwork, assembled our laptops, sought out our liquid refreshments, and got down to it.

“I freaking love TurboTax.”

My initial impressions of TurboTax was the enchanting UI: it was easy to understand, had an intuitive flow, and they even added icons (I appreciate such things). You go through and answer straightforward questions. If you don't know something, there are little info buttons to guide you, and they're actually helpful (angry eyebrows at you, MICROSOFT SUPPORT: take some time to reflect on yourself).

When it came time to figure out our rental income from Airbnb, I thought we were about to stress-eat some cookies: but even that wasn't so bad. Again: lots of helpful guides and digestible questions to figure out what actually had to be done.

One fun feature TurboTax includes is a sidebar that calculates your average return as you click through the modules. They probably designed it this way: but it usually goes up the further you get into filing your return. It's quite delightful.

We had to reference a lot of forms, access pay stubs online, log into our banks, and also look up spending history from the past year when we were itemizing deductions. Having two laptops handy was nice with all this referencing. We also had to enter numbers from last year’s tax refund at the end (probably to prevent fraud). This could easily eat up a lot of time to hunt down if you don't know where it is.

Overall, it wasn't as bad as I thought. We cranked through it in 2.5 hours (single filers can expect to take a bit longer) and we ended up paying $90 total: this was for an upgraded version to file our Airbnb tax goodness and also an extra charge to file state taxes (this differs state by state). You can even pay for TurboTax with your return (but important note: it is an added fee). It only took a week from filing to get the money back, though I imagine this timeline gets longer the closer it gets to April.

After staring at numbers for hours, we almost overlooked the added $35 fee to pay for TurboTax from our return money. We took 5 minutes to go back and pay with a credit card (no fee). At that point, it was sooo tempting to just click through and be done. But $35 is a decent chunk of money for less than five minutes of work.

To finish, we went out and had ourselves a tasty dinner at a brewery. I highly recommend you follow suit.

Turbotax: freaking awesome indeed.

Tax things to remember for next year

- Take pictures of donations. It's so easy to forget what you've gotten rid of, and if you're itemizing deductions, these things really add up.

- Stay organized. Because we rent our house on Airbnb when we're gone, we could actually write off a lot of things we bought for the extra bedrooms like sheets and towels. We bought everything through Amazon, so it was really easy to look back through the year's order history. Note to self: buy more things from Amazon.

- Keep a folder by the entryway for tax documents as they roll in. We've done this for two years now and it makes the whole process a lot easier.

- Pay attention when you fill out your W-4. This is the form you fill out at work so your employer withholds enough taxes. I've botched this badly two years in a row now by withholding too little and then overcompensating. Be thorough the first time around and you won't have to play catch-up halfway through the year.

- Get it over with. If you're a procrastinator, you'll feel better if you just do your taxes and then be done. Schedule it in the calendar. Pull that band-aid off.

- Don't forget to celebrate.

Now for the big question: what will you do with your tax return?